Business Analysis for Regulatory Reporting

Regulatory Reporting is submission of raw or summary data to the Regulators who determine the Financial Institution’s overall health by assessing the compliance needs according to regulatory provisions especially post the financial crisis.

Business Analysts understanding these requirements and providing solution that automates and streamlines the process to generate these reports in timely fashion is the need of the hour.

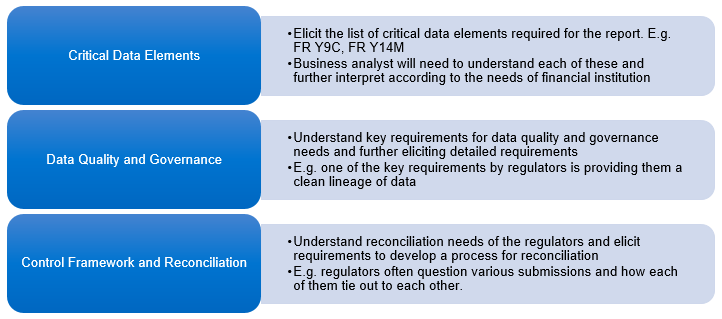

KEY COMPONENTS OF REGULATORY REPORTING

As a business analyst understanding of these key components of a regulatory reporting is key to delivering the right solution:

In the Regulatory Reporting world which is ever changing, business analysts need to be up to date with regulations and be well versed with data space in a financial institution.

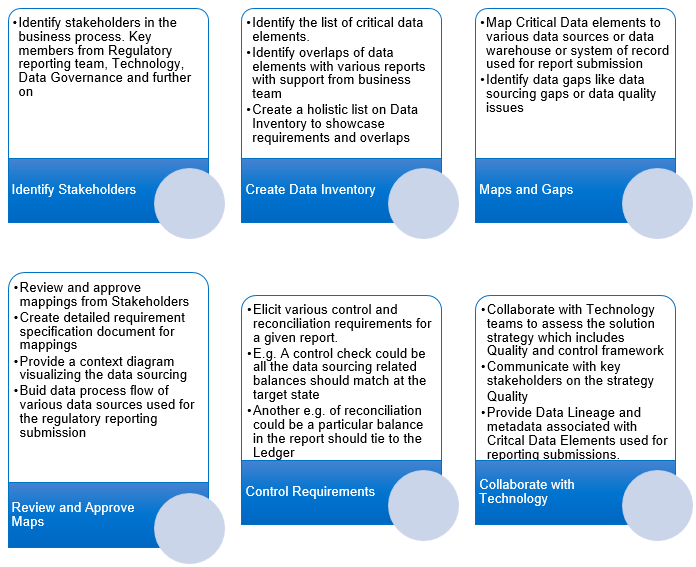

KEY ROLE OF BUSINESS ANALYST IN REGULATORY REPORTING

As a business analyst one can lead and direct in the regulatory space by:

Business analysts can translate these regulatory reports into business requirements and further advice data quality rules and control framework relevant to the financial institution. Challenging role as BA accelerate and excel in this ever changing world of regulations and become key drivers of meeting regulatory requirements.

드라마 다시보기

… [Trackback]

[…] There you can find 63633 more Information to that Topic: batimes.com/articles/business-analysis-for-regulatory-reporting/ […]