The BA Toolkit for Innovation

Folks, it is time to come to terms with one simple fact. In business, disruptions happen. They aren’t new.

You can make an argument that the first disruption happened 66 million years ago when the business of the Dinosaurs was disrupted by the meteor. And, since the start of the Technological Revolution, disruptions are a trend that is picking up.

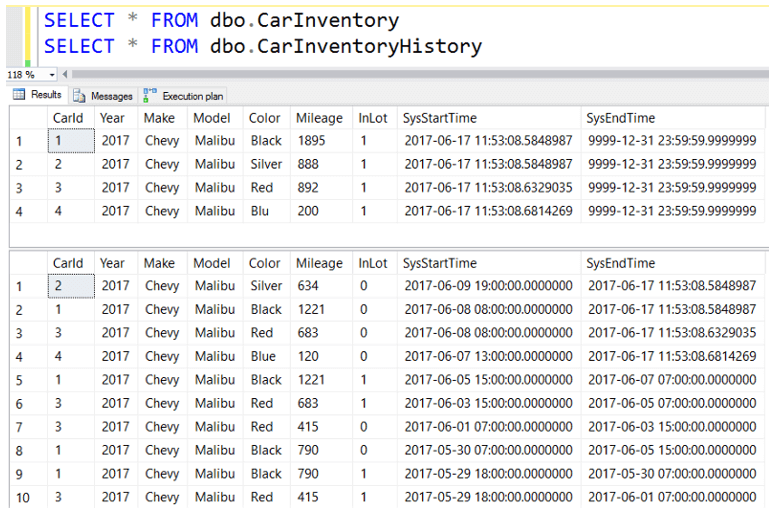

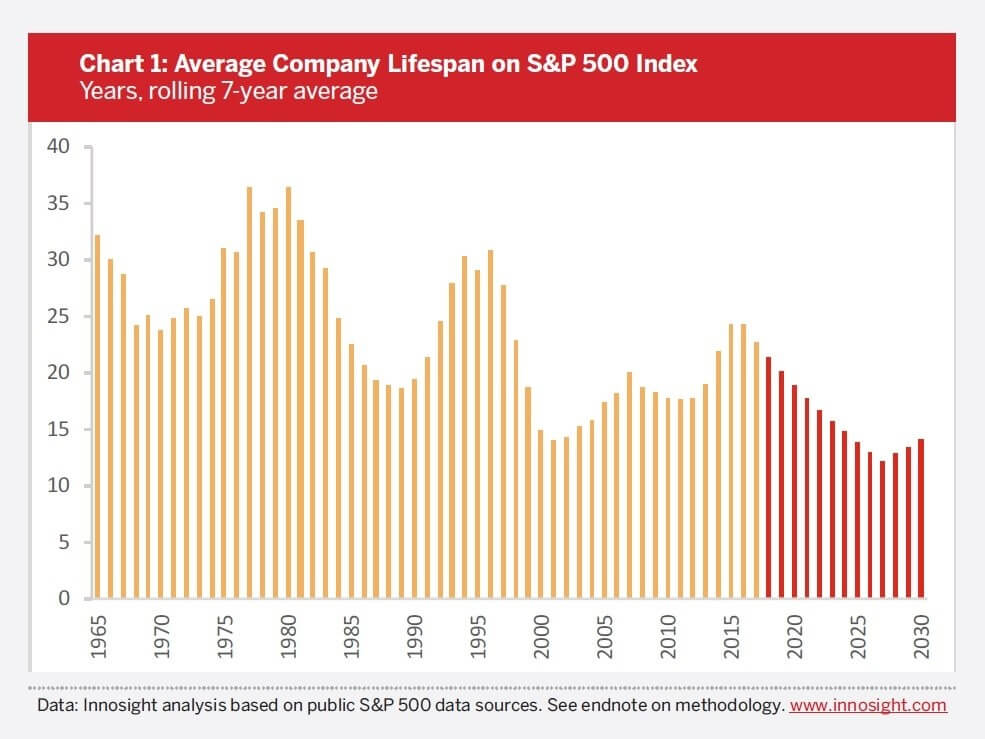

Today, because of increases in technology, available capital and global competition, they are prevalent than ever. Need proof? Look at the graph below brought to you curtesy of Innosight. Clearly, the trendlines on the average corporate lifespan are trending down.

Source: Innosight

Today, 93% of Executives know their industry will be disrupted within the next 5 years according to research performed by Accenture. Yet oddly enough, only 20% feel like they are ready for it. But, just as your corporate executives begin to belt out the lyrics the Mariah Carey’s “Hero” at their favorite local late-night karaoke spot, the Business Gods have delivered to them the hero they needed.

That hero’s name? The Business Analyst!

Business Analyst – Hero for Hire

OK, so, business analyst is more of a role than a person. But however you slice it, it is indispensable in the modern business climate.

We have a saying at Ever Evolving. Never launch an initiative that you don’t know will succeed. The best way to end up on the short side of that corporate lifespan chart above, is to raise a big fuss over something that nobody cares about. And it happens all the time.

There was the Ford Edsel. Microsoft Vista. BlackBerry Storm. Apple Newton. Shall I continue?

Okay. Facebook Home. The Alliance of American Football. Microsoft ME. Windows Phone.

Man, Microsoft has trouble with their product launches.

Anyway, still continuing… Sony Betamax. “New” Coke. Google Plus. Qwikster. Blockbuster Digital.

Sometimes companies launch pet projects that never find a market. Sometimes they see a new threat enter the market space, and they hurry to meet the challenge by launching prematurely. Either way, they both end in disaster. Some companies recover. Others don’t. But they are all avoidable.

And that’s where the BA comes in. Through their use of metrics, indictors, balance scorecards, and all the tools that you already know and love, you can prevent that bad launch. Through the use of small-scale experiments, or what we call Profit Scalability Pilots (PSPs), and timely and appropriate metrics, the BA can gage market interest. Allowing the Titanic to swerve and avoid that iceberg. Or blowing up a model Hindenburg before inviting in the crowd.

Through those experiments, you can learn key insights – such as:

- What users are really interested in my product?

- What features are the most important to our userbase?

- How much value is my product providing its intended audience?

- How likely is this product to succeed?

How Can You Do It?

The key is to capture that information before you launch. Companies need to provide safe space for new ideas to fail internally. Internal product failures are learning experiences. They bring new insights into your markets and build new capabilities. External failures are embarrassing and cost people their jobs. That’s where the BA comes in. They steer the ship towards the former and away from the later.

You work with your product developers, your sales staff, your marketing gurus and project managers to determine what insights are needed. You work with your PMs to identify the targeted user groups and determine which profitability metrics need to be captured and tracked. You work with your marketing staff to gather and track metrics about how the messaging is received. You track develop tasks to identify whether the build out is proceeding according to plan.

And that’s where the small-scale experiments come in. Call them what you want – whether you like our idea and call them a PSP or if you subscribe to the Eric Ries’ method and call them a Minimal Viable Product – the goal is to get something small released soonest to learn about the market. Learn about the challenges. And then track the metrics over time using your Balanced Score Card. Leverage your indicators to predict the effort’s likelihood of success. And then presenting that information to your corporate leadership.

Want to Hear More?

This is a topic near and dear to my heart. Which is why you’ll be able to hear me speak on it at two upcoming Project World Business Analyst Summit events. The first one is in Washington, DC, where I’ll be presenting on April 30th at 1:15pm in the Salon C room. The title of my talk is Analyzing Innovation Across Business Lines. Tickets are on sale now for the event, and they can be purchased on the Project Summit Business Analyst World website by clicking the “Register Now” button.

If you can’t make DC, that’s OK. Because the real fun is happening the following month in Toronto. In Toronto I’ll be presenting the same talk (with maybe a few new jokes?) on May 27th from 2-3pm. I’ll be following that up the following day, May 28th, by presenting Innovation: The New Currency of Business which highlights why it is imperative for your organization to focus on new initiatives and product lines. And then I’ll be closing the week with a full-day workshop on May 30th. The workshop, titled Charting a Course Through the Innovation Minefield, will provide a deep-dive on the various stages within a corporate innovation pipeline. And it will highlight where in the process those PSPs come into play, where the metrics are tracked, when the indicators are brought up, and exactly where and how the BA provides their value. Tickets for Toronto are also on sale, and you can find them here. Again, just click on the “Register Now” button on the landing page.