Transformative Impact of AI in Business Analysis

Integration of AI’s transformative potential into our analysis processes can unleash human potential, drive innovation, and foster a culture of continuous improvement. The future belongs to those who embrace AI in business analysis, and the time to seize this unparalleled opportunity is now. So, let’s take the leap together and unlock new horizons of success with AI as our ally.

The Fourth Industrial Revolution has ushered in a new era of technological innovation, and at the forefront of this revolution is Artificial Intelligence (AI). In the world of business analysis, AI has transcended its role as a buzzword and has become a game-changer in driving business growth and efficiency. AI has emerged as a powerful ally, empowering organizations to harness data-driven insights, streamline operations, and make more informed decisions.

Embracing AI in business analysis is no longer a choice but a strategic imperative for companies looking to gain a competitive edge and thrive in today’s dynamic marketplace. Let’s delve into the transformative impact of AI in business analysis and understand how organizations can leverage this cutting-edge technology to unlock new horizons of success.

The Power of Data-Driven Insights

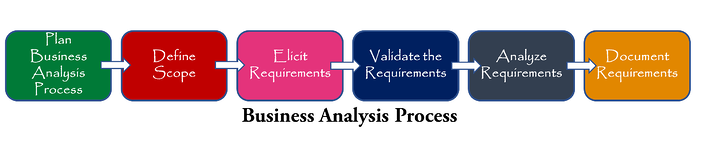

At the heart of business analysis lies data, and the ability to extract meaningful insights from vast datasets can make or break an organization’s success. AI-driven analytics tools have revolutionized this process by processing large volumes of data at unparalleled speeds and advanced algorithms to provide real-time, data-driven insights. By employing machine learning algorithms, AI can identify patterns, trends, and correlations that may remain hidden from traditional analysis methods.

With AI-powered data analysis, businesses gain a deeper understanding of their customers, markets, and industry dynamics. This data-driven approach empowers decision-makers to make well-informed decisions promptly, minimizing risks and optimizing opportunities. Organizations can harness a more comprehensive understanding of their markets, customers, and competitors, optimizing their marketing strategies, fine-tuning product offerings, identify emerging market trends, driving innovation, growth, competitiveness, and profitability.

Automation: Unleashing Human Potential

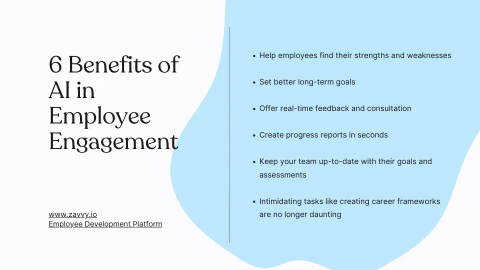

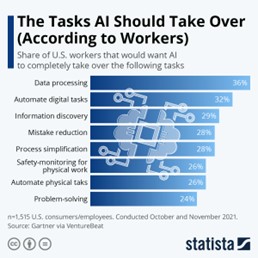

Business analysts are often burdened with repetitive and time-consuming tasks, leaving little room for strategic thinking. AI automation can alleviate this burden, liberating analysts from mundane activities and allowing them to focus on higher-value initiatives that require creativity, critical thinking, and strategic planning.

AI-powered automation can handle data collection, data cleaning, report generation, and even predictive modeling. As a result, business analysts can dedicate more time to interpreting results, formulating strategic plans, and collaborating cross-functionally. This not only enhances productivity but also fosters a culture of innovation within the organization.

Personalizing Customer Experiences

In an era where customer experience reigns supreme, personalization has become a key differentiator for businesses. AI plays a pivotal role in this domain by enabling businesses to personalize interactions with customers. Leveraging AI-driven analysis, organizations can understand individual customer preferences, behaviours, needs, and engagement patterns to segment customers. This enables businesses to hyper-personalized product recommendations and tailored marketing campaigns to individual customers.

By delivering personalized experiences, businesses can foster increased customer loyalty, satisfaction, ultimately leading to increased revenue and brand advocacy.

Predictive Analytics: Anticipating the Future

Traditional business analysis often focuses on historical data, providing a retrospective view of performance. However, in today’s fast-paced business environment, organizations must be forward-thinking and anticipate future trends and challenges. AI-driven predictive analytics enables just that. By analysing historical data, market trends, and external factors through sophisticated predictive models, AI can forecast future trends, demand patterns, identify potential risks, and anticipate changing customer preferences empowering organizations to make proactive decisions.

Armed with these insights, businesses can proactively adapt their strategies, pre-emptively address challenges, seize new opportunities as they arise and can stay ahead of the curve and gaining a competitive edge.

Advertisement

Improving Fraud Detection and Risk Management

In an increasingly interconnected world and increasing digitization of business processes, cybersecurity threats and fraudulent activities have become major concerns for organizations. AI excels in detecting anomalies and patterns indicative of fraudulent activities. AI-driven fraud detection models can learn from historical data to identify suspicious patterns and flag potential fraudulent transactions promptly.

Additionally, AI-powered risk management tools can assess and mitigate risks, helping businesses safeguard their assets and maintain trust with customers and stakeholders.

Conclusion: Unlocking New Horizons of Success

Embracing AI in business analysis is no longer an option; it’s a necessity for organizations that aspire to thrive in today’s dynamic market. From data-driven decision-making and process automation to personalized customer experiences and predictive analytics, AI’s impact on business analysis is undeniable.

As business analysts and leaders, embracing AI unlocks new horizons of success, driving growth, innovation, and efficiency. It’s time to seize the transformative power of AI and shape the future of our businesses with confidence and enthusiasm. So, let us embark on this exciting journey of AI-driven business analysis and embark on a path of unrivalled success.